what we provide

BizSculptor is a one service consultancy specialising in Business Diagnostics. Our primary service offering is The Profit Autopsy which is part of our Business Diagnostician Model.

Our Services

The Business Diagnostician

Forensic Analysis for Businesses Bleeding Money and Crashing Profits

I Don’t Give Advice. I Perform Autopsies on Living Businesses.

After 30 years of running companies, raising millions, and yes—failing spectacularly at times – I’ve learned one truth: Most business problems aren’t mysteries. They’re just hidden. I’m Jasjit Gill, and I’ve developed a unique diagnostic methodology that uncovers exactly what’s killing your profits and cashflow. No meetings. No theories. Just a forensic examination of your business that reveals what others miss.

Why I Became The Business Diagnostician

During my time as Executive Director of Kunlun Energy Limited in Hong Kong, I watched profitable divisions suddenly hemorrhage money. As Manager of Corporate Finance at an Investment Bank, I saw healthy companies collapse from preventable problems. When my own $450,000 skincare venture failed, I realized the pattern: Businesses don’t fail from lack of effort. They fail from undiagnosed problems. After three decades of:

- Managing multi-million dollar operations

- Structuring IPOs and acquisitions

- Building (and losing) my own businesses

- Drafting the legal documents that save companies

I’ve seen every way a business can bleed money. More importantly, I’ve learned to spot the symptoms before they become fatal.

The Profit Autopsy

Discovering What’s Killing Your Profits and Cashflow Before It Kills Your Business

Your Business Is Sick. You Just Don’t Know Where.

You feel it in your gut – something’s wrong. Revenue looks decent, you’re busy as hell, but profits remain elusive. You’ve tried everything: new marketing, different pricing, longer hours. Nothing works because you’re treating symptoms while the disease spreads. The Profit Autopsy is a forensic examination of your entire business operations. Using methodologies developed through decades of corporate turnarounds and business rescues, I identify exactly where money is leaking, why growth has stalled, and what’s preventing profitability.

What Makes This Different

1. Real Experience, Not Theory

When I analyze your:

- Cash flow problems – I’ve managed through crises at both corporate and startup levels

- Partnership disputes – I’ve navigated them in boardrooms and small businesses

- Operational inefficiencies – I’ve run everything from oil fields to retail stores

- Failed strategies – I’ve made the $450,000 mistakes so you don’t have to

2. Corporate Rigor, Small Business Reality

I bring Fortune 500 diagnostic tools (from my investment banking and public company days) adapted for small business realities. You get institutional-level analysis without institutional fees.

3. Legal and Financial Precision

As a qualified Barrister-at-Law with decades in corporate finance, I see what others miss:

- Contract terms costing you thousands

- Legal structures limiting growth

- Financial arrangements destroying margins

- Compliance issues creating hidden risks

The Diagnostic Process

Phase 1: The Evidence Collection

Your Time: 2-3 Hours. You complete our comprehensive diagnostic questionnaire -150+ questions developed from analyzing hundreds of business failures and turnarounds. Upload your financials, describe your operations, detail your challenges.

Phase 2: The Forensic Analysis

My Work: Deep Investigation I examine your business through multiple lenses:

The Financial Autopsy

- Where every dollar comes from and goes

- Hidden costs eating 30-40% more than necessary

- Pricing gaps leaving money on the table

- Cash flow killers you haven’t identified

The Operational Investigation

- Process bottlenecks limiting all growth

- Systems failures costing thousands monthly

- Quality issues damaging reputation

- Efficiency gaps versus industry standards

The Strategic Assessment

- Market position weaknesses

- Competitive disadvantages

- Growth barriers (visible and invisible)

- Opportunities you’re missing

The Legal/Risk Review

- Contract terms hurting profitability

- Compliance issues creating exposure

- Structure limitations preventing scale

- Protection gaps risking everything

Phase 3: The Diagnosis Report

Your Blueprint: 320-40 Pages of Specific Solutions. You receive a comprehensive document that becomes your business transformation blueprint:

Executive Summary (2 pages)

The 3-5 critical issues killing your profitability and cashflow, ranked by impact

Detailed Findings (10-20 pages)

- Specific problems with evidence

- Financial impact of each issue

- Root cause analysis

- Industry comparisons

The Prescription (5-15 pages)

- Step-by-step solutions for each problem

- Quick wins implementable immediately

- 30-60-90 day transformation plan

- Specific scripts, templates, and tools

- Vendor recommendations where applicable

- Success metrics to track progress

Financial Recovery Model (2-5 pages)

- Projected savings from recommended changes

- Revenue opportunities identified

- ROI timeline for implementations

- Cash flow improvement forecast

Who This Is For

Perfect Fit:

✓ Businesses doing $500K-$5M in revenue

✓ Operating for 2+ years (enough data to analyze)

✓ Owners working too hard for too little return

✓ Companies that should be more profitable

✓ Leaders ready to face hard truths

Not Suitable For:

✗ Startups with no operating history

✗ Businesses wanting validation, not truth

✗ Companies needing hand-holding implementation

✗ Organizations where ego trumps evidence

Why Choose The Business Diagnostician

I’ve Lived Your Problems

When you’re struggling with:

- Cash flow despite “profits” – I managed this at Kunlun Energy with million-dollar swings

- Failed marketing channels – My $450,000 skincare company died from this exact mistake

- Economic downturns – I closed my oil filtration business during the 2008 recession

- Scaling challenges – I’ve grown operations from startup to public company

- Partnership issues – I’ve seen them implode at every level

I don’t just understand your problems—I’ve solved them or learned from failing at them.

Unique Qualifications

The combination you won’t find elsewhere:

- 30+ years across multiple industries and countries

- Legal expertise to spot contract and compliance issues

- Corporate finance background for sophisticated financial analysis

- Real entrepreneurial experience including failures and successes

- No need for meetings – I respect your time as much as mine

Investment & Delivery Options

The Profit Autopsy Standard

Investment: $2,497

- 14 business day turnaround

- 30-40 page diagnostic report

- Implementation templates included

- 30 days email support for clarifications

The Profit Autopsy Express

Investment: $3,997

- 5 business day turnaround

- 30-40 page diagnostic report

- Implementation templates included

- One 60-minute call to discuss findings (optional)

- 60 days email support

The Profit Autopsy Quarterly

Investment: $8,997

- Initial diagnosis + 3 quarterly reviews

- Track implementation progress

- Adjust recommendations based on results

- Ongoing problem-solving support

- Best for businesses serious about transformation

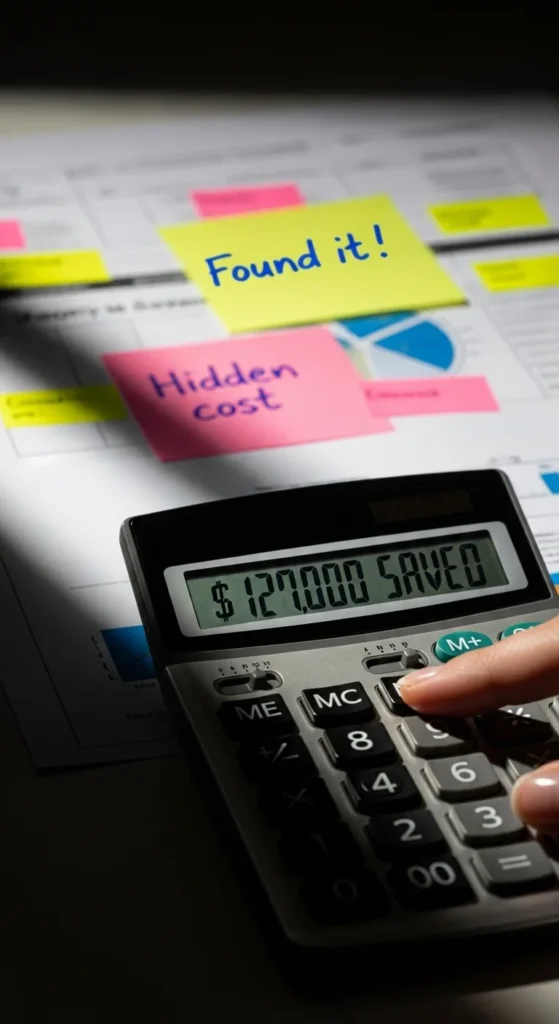

The ROI Reality

My average client identifies $50,000-500,000 in recoverable profits. Most recover my fee within 30 days just from implementing the “quick wins” section. Recent client results:

- Service Business: Found $8,000/month bleeding from unprofitable service line

- E-commerce: Identified $127,000 in annual operational savings

- Manufacturing: Discovered inventory practices costing $200,000 yearly

- Consulting Firm: Revealed pricing strategy leaving $150,000 on the table

The Guarantee

If The Profit Autopsy™ doesn’t identify opportunities worth at least 10x my fee, I’ll refund everything. That’s how confident I am in finding money you’re currently losing .But here’s what I won’t guarantee: That you’ll implement the solutions. That’s on you.

Ready for the Truth?

Your business problems aren’t unique. They’re just undiagnosed. After 30 years of seeing businesses succeed and fail (including my own), I’ve learned to spot patterns others miss.Stop guessing. Stop treating symptoms. Stop leaving money on the table.

Get your Profit Autopsy and discover what’s really killing your profits.[

Start Your Profit Autopsy Now]

Frequently Asked Questions

Q: Why no meetings?

A: After 30 years of meetings, I’ve learned most are wastes of time. Data tells the truth. Numbers don’t lie. Everything I need to diagnose your business is in your data, not your explanations.

Q: How do you analyze without seeing operations?

A: Your financial statements, operational metrics, and questionnaire answers reveal more than any site visit. I’ve managed businesses remotely across continents. The problems show up in the patterns.

Q: What if I need help implementing?

A: The report includes step-by-step instructions, templates, and resources. If you need additional support, I can recommend implementation specialists or you can upgrade to the Quarterly package for ongoing guidance.

Q: Is my data secure?

A: Bank-level encryption. Standard NDAs. Everything deleted after 90 days. I’ve handled confidential information for public companies—your data is safe.